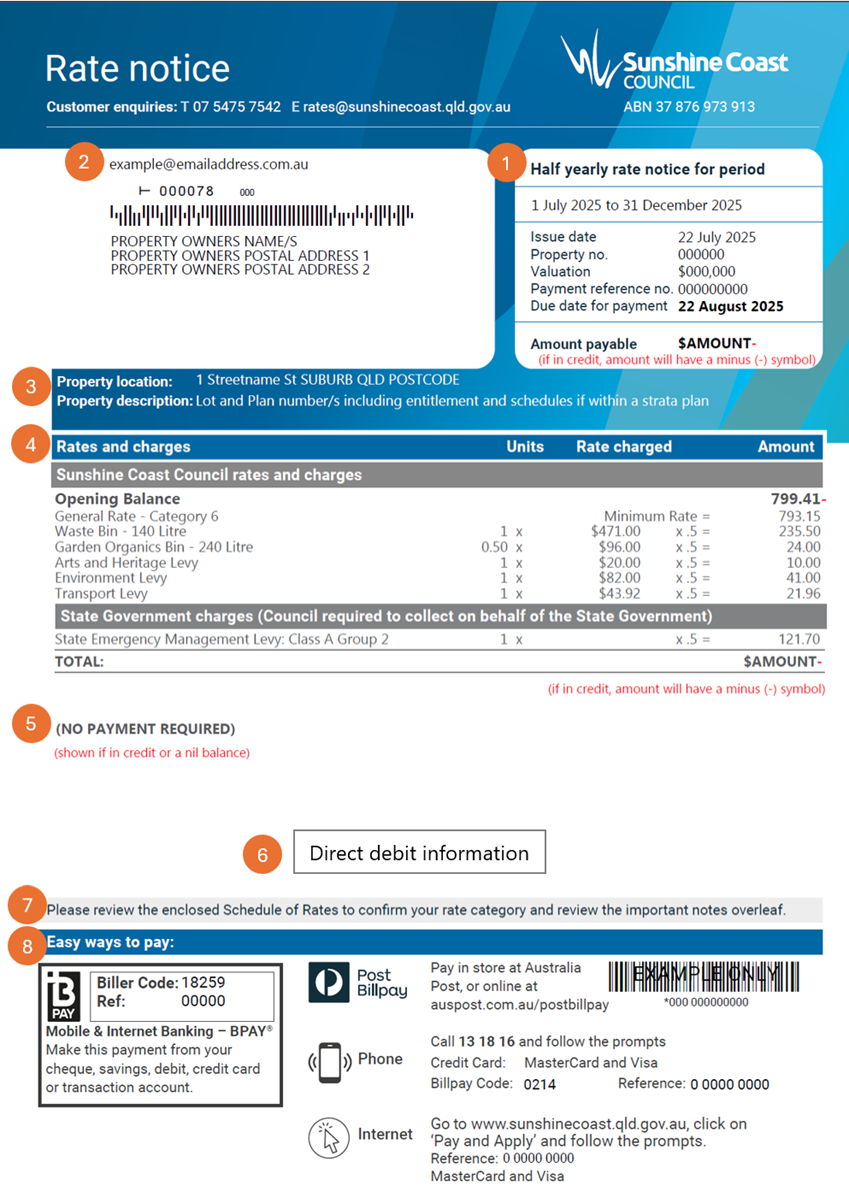

Your rate notice explained

This page explains the information shown on your rate notice. Each numbered item in the sample rate notice is explained in the guide below.

Note: This example has been prepared as a guide only, the information and figures may not be a true reflection of a current rate notice.

Your guide to reading your rate notice details

1. Rate notice details

1. Rate notice details

Rate notice period

Council issues rates notices twice a year:

- in January for the 6-month period of 1 January to 30 June, and

- in July for the 6-month period of 1 July to 31 December.

Additional supplementary rate notices may also be issued when there have been adjustments to the rates and charges levied in January or July, or for a change of ownership.

Issue date

The date the rate notice is issued.

Property no.

This is your unique Council reference number to use if you contact Council regarding your property.

Valuation

The valuation issued by the Department of Natural Resources and Mines, Manufacturing and Regional and Rural Development to Council.

Payment reference no.

This is your unique payment reference number to be used when paying your rate notice. This reference number is also shown in the payment options in the Easy ways to pay section of the rate notice.

Amount payable

This is the amount payable by the due date. If the amount is a credit, it will display with a - (minus) symbol on the end of the number. See item 5 below if a credit is shown.

2. Notices received by email

2. Notices received by email

If you have registered with Council to receive your rate notice by email, this is the email address that will be used to issue your rate notices.

3. Property details

3. Property details

Property location

The rates and charges are for this property address.

Property description

This is the legal description of the property, as per the title deed.

4. Rates and charges

4. Rates and charges

Some of the rates and charges listed below may not appear on your rate notice if they don’t apply to your property.

Opening balance

This is your rate account balance prior to the issue of this notice. A credit is shown with a -(minus) symbol on the end of the number, as shown in this example.

Overdue rates and charges

If the rates were not paid in full before the rate notice was created, the first line on your rate notice will show the overdue amount.

Differential general rate category

Information on your differential general rate category can be found on the schedule of rates enclosed with your rate notice, online at rates information, or online in Council’s current financial year revenue statement (PDF, 6.6MB).

An example of the general rare calculation for a property with a valuation of $530,000, within rate category 6, is below. This example is based on the 2025/26 general rate cents in the dollar for category 6 of $0.3140 and the minimum rate of $1,586.30 for the year.

$530,000 x 0.3140* = $1,664.20 x 0.5 (half year) = $832.10. This is above the minimum amount of $793.15 for the half year period for Category 6, therefore; this calculated amount is charged.

If the result of the calculation (the rateable value multiplied by the cents in the dollar charge) is below the Minimum Rate for the rate category, the Minimum Rate is charged.

*The cents in the dollar for the rate category shown in the schedule of rates. This is divided by 100 to calculate the charge as it is a cent in the dollar amount.

Waste management charges

Your waste bin collection charges. Full information can be found online in Council’s 2025-26 Revenue Statement (HTML/PDF, 6.6MB). Further information on waste collection services can be found at bin collection services.

Other charges - separate levies

Levies charged on all rateable land:

- Arts and heritage levy

- Environment levy, and

- Transport levy.

Special charges

A charge levied on some, rateable land for activities and/or services over and above the standard level of service or activity applied by council for specific areas.

State emergency management levy

This levy is set by the State Government and is required to be collected by Council and submitted to the State Government in accordance with the Fire Services Act 1990. This levy is charged based on the use of the property, and the location, and is charged for each property lot/s. Further information can be found at: https://www.qfes.qld.gov.au/planning-and-compliance/em-levy.

Other items

Your rate notice may include other items not shown on the sample rate notice such as state government pensioner rate subsidy, Council pension concession, differential general rate concessions, differential general rate deferments, change of ownership fee, valuation fee, backflow charges, overdue clearing land/noxious weeds and overdue infrastructure charges.

5. No payment required

5. No payment required

If your rate account has a nil balance or a credit, the rate notice will display as (NO PAYMENT REQUIRED).

6. Direct debit

6. Direct debit

This note is shown on rate notices that have a current direct debit in place with Council. You can have a direct debit in place to pay your rates by either:

- in full on the due date (shown on the rate notice at item 1.)

- by instalments before the due date, so the full amount is paid by the due date, or

- by using a direct debit to pay by instalments after the rate notice issued.*

*Please note a direct debit is a payment method, and not a payment plan (which is a plan showing the amount of each instalment payment you need to make to pay the rates). If you have a balance owing on your rate account after the due date, a payment plan should be requested.

You can request a payment plan, to pay your rate notice by instalments by clicking on the “pay and apply” menu on our website, then select create a payment plan to pay your rates.

7. Information

7. Information

This note is to remind you to check your differential general rate category when you receive a rate notice by reviewing the Schedule of Rates brochure or Rating Category Statement that is issued with your rate notice. This brochure may also be viewed on our rates information webpage.

8. Easy ways to pay

8. Easy ways to pay

This section shows some of the easy ways to pay your rates. Other payment options are detailed on the back of your rate notice.